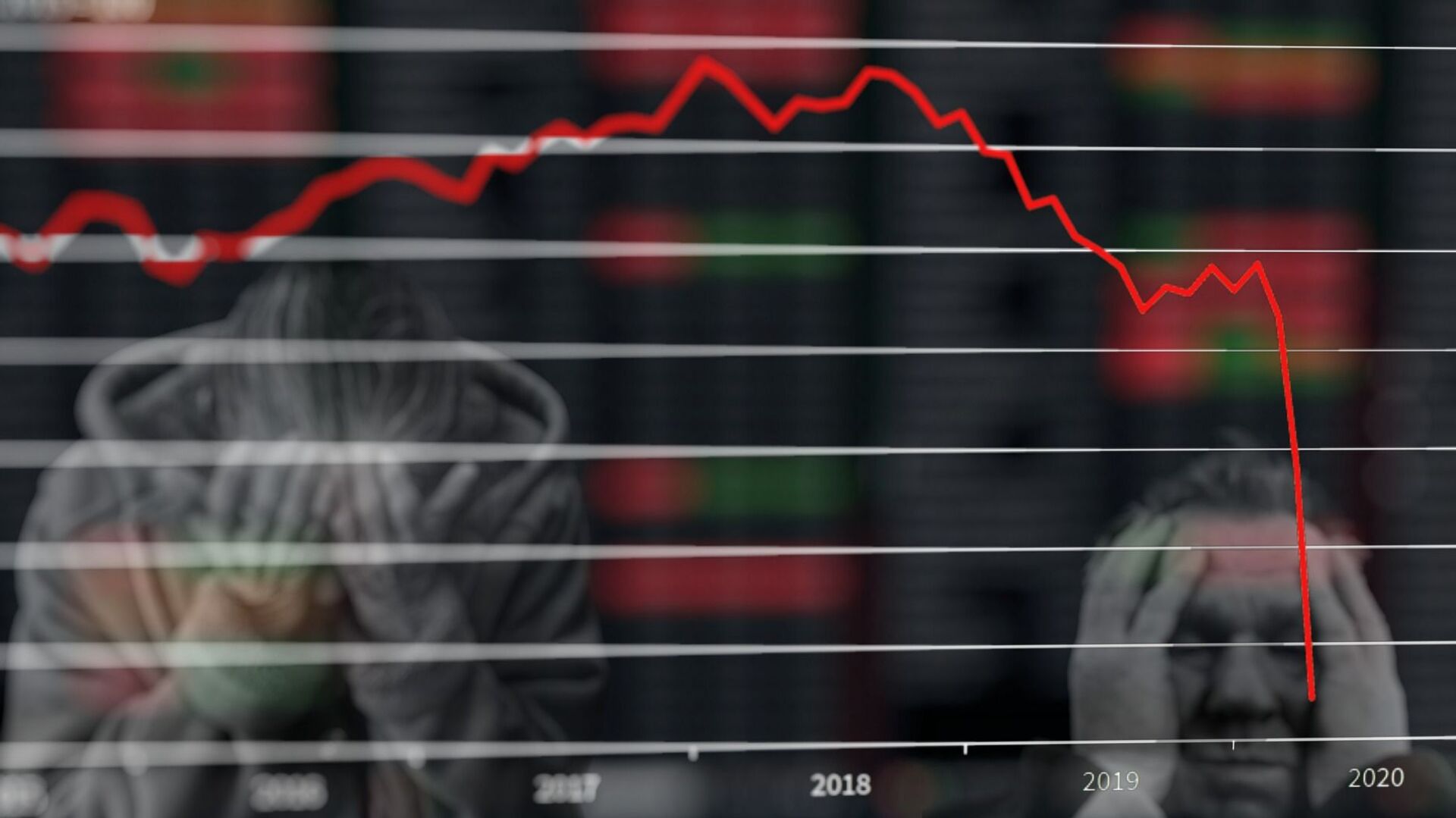

Today, almost everyone has heard of economic recessions and has some familiarity with them. A recession is one of the worst events for financial markets, capable of causing numerous adverse consequences. In this article, we will delve into the concept of a recession and the factors that cause it. Join us to learn more.

Recession in Simple Terms

A recession is a significant decline in economic activity that lasts for months or even years. Experts declare a recession when a country’s economy experiences negative GDP (Gross Domestic Product), rising unemployment levels, declining retail sales, and decreasing income and production metrics over a prolonged period. Recessions are considered an inevitable part of the business cycle, which is the regular pattern of expansion and contraction in a country’s economy.

Official Definition of a Recession

During a recession, the economy struggles, people lose their jobs, companies experience lower sales, and the country’s overall economic output declines. The point at which an economy officially enters a recession depends on various factors.

In 1974, economist Julius Shiskin provided several rules of thumb for defining a recession, the most popular being two consecutive quarters of declining GDP. According to Shiskin, a healthy economy expands over time, so two consecutive quarters of GDP decline indicate serious underlying problems. Over the years, this definition of a recession has become a common standard.

What Causes a Recession?

There are many factors that can lead to a recession. Here are some of the most common and significant reasons for economic recessions:

Sudden Economic Shocks

An economic shock is a surprise problem that causes serious financial damage. n the 1970s, OPEC abruptly cut off oil supply to the U.S., leading to a recession and creating numerous issues in U.S. and global markets. The COVID-19 pandemic, which caused economies to shut down worldwide, is a recent example of a sudden economic shock.

Excessive Debt

When individuals or companies borrow too much, the cost of servicing the debt can increase to a point where they can’t pay their bills. Rising debts and subsequent bankruptcies can topple the economy.

Asset Bubbles

When investment decisions are driven by emotions, poor economic outcomes are not far behind. Investors can become overly optimistic during a strong economy and make emotional decisions. Former Federal Reserve Chairman Alan Greenspan referred to this tendency as “irrational exuberance” when describing the excessive stock market gains in the late 1990s. Irrational exuberance inflates stock market or real estate bubbles – and when these bubbles burst, panic selling can crash the market and lead to a recession.

Excessive Inflation

Inflation is the steady upward trend of prices over time. While inflation itself isn’t inherently bad, excessive inflation is dangerous. Central banks control inflation by raising interest rates, and higher interest rates reduce economic activity. Out-of-control inflation was a persistent problem in the U.S. during the 1970s. To break this cycle, the Federal Reserve rapidly increased interest rates, leading to a severe recession.

Excessive Deflation

While rapid inflation can trigger a recession, deflation can be even worse. Deflation occurs when prices decrease over time, leading to lower wages and further price drops. When a deflationary feedback loop spirals out of control, people and businesses stop spending, which weakens the economy. Central banks and economists have few tools to address the fundamental issues causing deflation. japan’s struggle with deflation during much of the 1990s led to a severe recession.

Leave a Reply