Price Action (PA) is a method of analyzing price movements on charts and making trading decisions based on these fluctuations. Unlike many trading methods that rely on complex indicators and tools, Price Action focuses on pure price movement, enabling traders to implement their strategies with simplicity and by using fundamental market principles. In this article from Toofan Trading Academy, we examine the concept of Price Action and present a few successful forex trading strategies based on this approach.

1. The Concept of Price Action

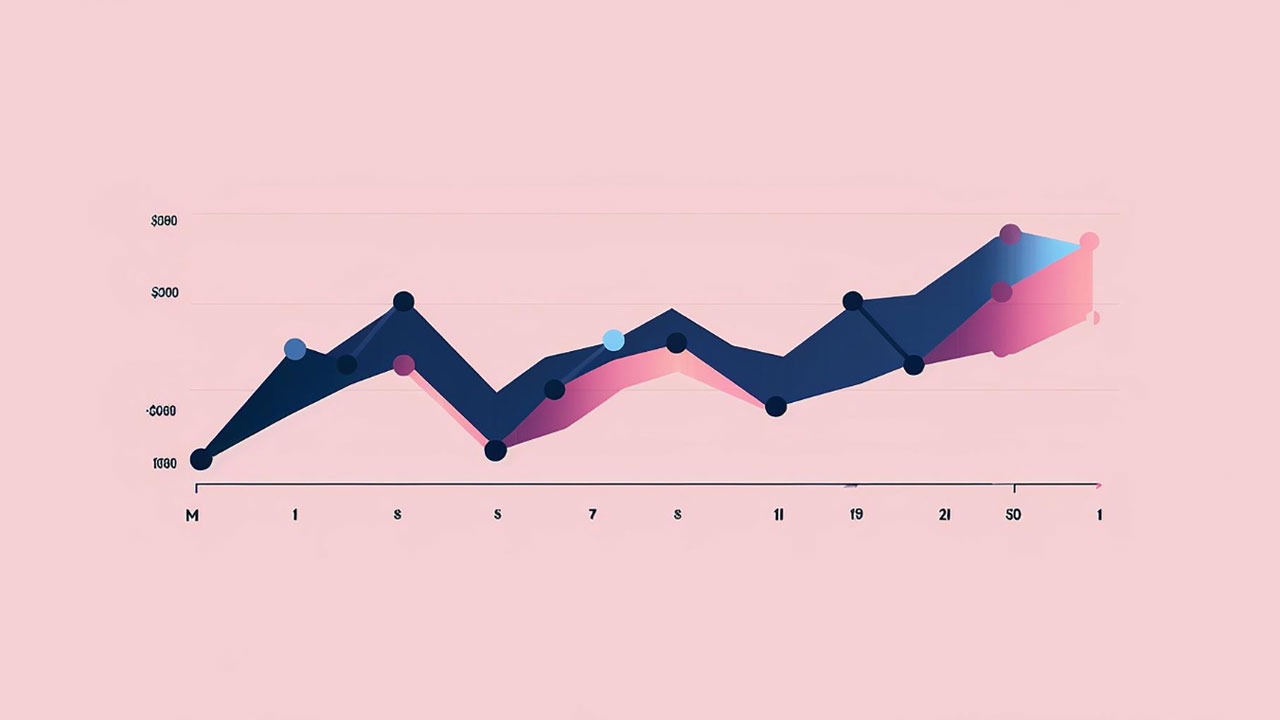

Price Action refers to the analysis of price movements using candlestick or line charts. This method allows traders to make decisions based solely on price actions and patterns in the market without using complex indicators. The core idea behind Price Action is that all the necessary information for market decision-making lies in the prices and their behavior.

Price Action operates on the principle that past price behavior can provide clues about potential future movements. By analyzing candlesticks and reviewing support and resistance levels, traders can identify potential trading opportunities.

2. Key Price Action Patterns

Price Action focuses on several key patterns that frequently appear on forex charts. These patterns can serve as indicators of price reversals or continuations.

a) Pin Bar Pattern

The Pin Bar is one of the most famous Price Action patterns and is used as a strong signal for price reversals. This pattern consists of a candlestick with a small body and a long wick, indicating a sudden change in price direction. Professional traders often use this pattern near key support and resistance levels to identify entry opportunities.

b) Inside Bar Pattern

An Inside Bar pattern forms when the current candlestick closes within the range of the previous candlestick. This pattern indicates consolidation and pressure in the market, which may lead to a strong move once the price breaks out of the candlestick range. Traders can expect a sudden market move and prepare to enter trades after spotting this pattern.

Read More: How to Use Leading and Lagging Indicators in Forex Technical Analysis

c) Engulfing Pattern

The Engulfing pattern occurs when the second candlestick fully covers the previous one. This pattern is seen as a strong reversal signal, prompting traders to consider trade entries based on it.

3. Successful Strategies Using Price Action

Price Action allows traders to implement effective trading strategies by analyzing simple charts without using complex indicators. Here are some successful strategies using Price Action:

a) Pin Bar Strategy at Support and Resistance Levels

This strategy is based on identifying the Pin Bar pattern near support and resistance levels. Traders spotting this pattern at key points can enter trades expecting a price reversal. For example, if a Pin Bar forms near a resistance level, it may indicate a downward price movement.

b) Inside Bar Strategy in Strong Trends

The Inside Bar strategy is often useful in strong trends or during market consolidation. When an Inside Bar forms in a bullish or bearish trend, traders can enter trades after breaking out of the pattern’s range, allowing them to join strong trends with minimal risk.

c) Engulfing Pattern at Reversal Points

The Engulfing pattern is regarded as a powerful reversal signal. When this pattern appears near key support or resistance levels, traders can use it as a trade entry opportunity. For instance, a bullish Engulfing pattern near a support level may signal the start of an upward move.

4. Risk Management in Price Action Trading

One of the core principles of Price Action trading is effective risk management. Professional traders always enter trades by setting Stop Loss and Take Profit levels, helping them control potential losses even if their analysis turns out to be incorrect.

Read More: Forex Trading Strategies for Volatile Market Days

a) Using Stop Loss Below/Above Key Levels

In Price Action strategies, traders typically set their Stop Loss below support or above resistance levels, enabling them to exit trades in case of a breakout, thus preventing more significant losses.

b) Maintaining a Favorable Risk-to-Reward Ratio

A crucial element of success in Price Action trading is maintaining an appropriate risk-to-reward ratio. Professional traders always aim for a minimum risk-to-reward ratio of 1:2, meaning they earn twice as much profit as their risk if the trade succeeds.

5. Benefits of Using Price Action in Forex

Price Action offers multiple advantages for forex traders, making it one of the most popular market analysis methods:

a) Simplicity in Analysis

Price Action simplifies market analysis by using straightforward charts without complex indicators. Traders don’t need to master advanced tools and can identify trading opportunities by observing charts and recognizing price patterns.

b) High Flexibility

Price Action is applicable across all markets and time frames, allowing traders to apply diverse strategies in different market conditions based on their trading style.

c) Immediate Decision-Making

Unlike indicators that often react to price changes with a delay, Price Action allows traders to make quick and timely decisions by directly analyzing price movements.

Conclusion

Price Action is one of the most effective and widely used analysis methods in the forex market, enabling traders to create successful strategies by using price movements and simple patterns. Combining this method with proper risk management and thorough market analysis allows traders to achieve sustainable profitability in forex trading.

Leave a Reply